Arab Women’s Enterprise Fund's (AWEF) study in Egypt on leveraging 'Fintech' innovations to create meaningful financial solutions for low-income people, especially poor or disadvantaged women.

Fintech is often talked about as a revolution - but in Egypt it is more of a democratisation.

By making financial services more widely available and lowering costs and barriers to access finance, financial technology (fintech) can democratise financial services to the masses – starting with the 23.2 million Egyptian women who remain excluded from the formal financial system.

In a bid to accelerate women’s financial inclusion in MENA, the region with the lowest female economic participation in the world, the DFID-funded Arab Women’s Enterprise Fund (AWEF) led a study to understand

- the scope for Digital Financial Services (DFS) in Egypt

- map key constraints to women’s financial inclusion

- identify opportunities to transform the livelihoods of low-income Egyptian women through improved access to finance.

This blog highlights the main findings of this study by:

- setting the scene on the gender finance landscape in Egypt

- mapping key stakeholders in the women’s financial inclusion ecosystem

- identifying main constraints to female access to, and control over, financial resources

- presenting AWEF’s strategy to democratise financial services for poor women in Egypt

Setting the scene: women’s financial and economic exclusion in Egypt

Access to financial resources is widely acknowledged as a key condition to women’s economic empowerment. In Egypt, women’s economic and financial empowerment is a governmental priority. Even though female financial inclusion is on the rise, women remain disproportionately excluded from the formal financial system.

Only 27 per cent of adult women have a financial account (versus 39 per cent for men). A gender gap of 12 percentage points that has not only increased over the last three years but also remains considerably above the global average for developing markets. Putting this into perspective: Egypt now has about 23.2 million un-banked or under-banked adult women.

Understanding the market: a financial sector largely dominated by microfinance institutions, with a growing fintech scene

At present microfinance is the most effective financial sub-sector serving the unbanked and underbanked in Egypt, especially women.

In Q2 of 2018 microfinance beneficiaries reached 2.9 million, out of which 70 per cent were women. Yet, with more and more women owning mobile phones, digital finance now offers promising opportunities to further increase women’s access and agency over financial resources – both at the microenterprise and household levels.

Egypt currently has around 9-10 million mobile wallets, a type of payment tool through which individuals and businesses can receive and send money via mobile devices. These innovative solutions can act as an entry point to financial services for unbanked women. They can allow them to pay their bills or suppliers, collect payments from clients, send money to their loved ones, store small savings in a safe place or even receive social-cash transfers - in a cheaper, safer and easier way.

One such example is the Nafaqa social benefit programme, the first digital government-to-person (G2P) programme in Egypt. This digital social transfer solution aims to facilitate the disbursement of allowances (previously disbursed in cash) to about 390,000 widows or divorced Egyptian women. Nasser Bank launched this service in October 2017 in partnership with the four mobile operators. Five months into the launch, registration of more than 11,783 women was reported.

Soon female microfinance borrowers will also be able to pay their loan instalments in one single tap from their mobile. This will save long hours of transport and queues to visit a physical branch, as well as the missed revenues associated with closing their micro-business for a few hours.

For these reasons AWEF is partnering with leading fintech and financial firms to encourage women’s digital financial inclusion in Egypt. By ensuring that we work to address the systemic constraints to women accessing and using digital finance, we will enable more women to profit from the socio-economic benefits associated with such innovative services.

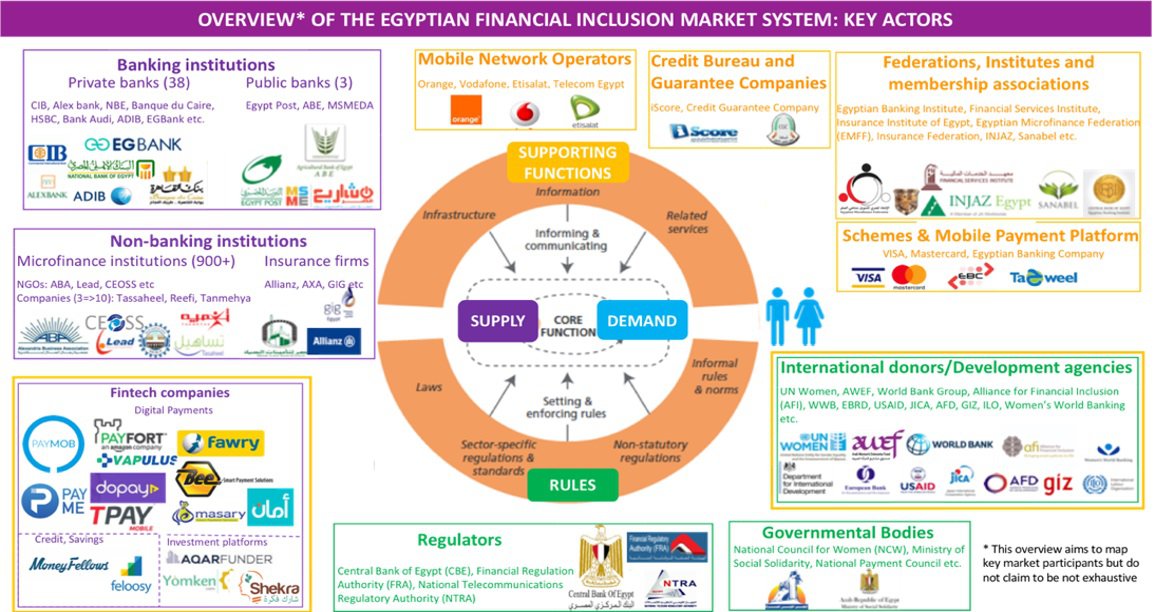

The infographic above summarises AWEF’s Financial Inclusion stakeholder mapping according to the four functions needed to make financial markets work for women.

The infographic above summarises AWEF’s Financial Inclusion stakeholder mapping according to the four functions needed to make financial markets work for women.

Identifying systemic constraints hindering women’s access to, and use of, financial services

In June 2018, AWEF conducted a market assessment of the women’s financial inclusion sector in Egypt. AWEF used a dual research approach:

- by collecting and analysing primary data via more than 30 stakeholder interviews

- by using secondary research to consolidate existing data such as the Global Findex database.

This holistic study helped inform AWEF’s financial inclusion strategy and was extensively shared within the broader Egyptian financial landscape. The study outlined three types of constraints - from the demand-, supply- and environment-side. While not specific to women only, these constraints appeared to be experienced by women in a more acute way, as per the infographic below.

Building upon opportunities: AWEF’s strategy to help Egyptian women scale the financial inclusion pyramid

In a bid to bridge these three types of constraints while capitalising on the fast-growing digital finance ecosystem, AWEF developed a three-level intervention strategy to help poor women scale the financial inclusion pyramid in Egypt:

- At the end-beneficiary level AWEF is working to increase awareness, understanding and trust of digital financial services among poor women, both as individual consumers and/or entrepreneurs. AWEF facilitated the introduction of the very first e-learning platform in Arabic targeting more than 3,500 low-income female microbusiness-owners in Egypt, It is in partnership with Vodafone Egypt and Tasaheel Microfinance, a leading microfinance institution.

- At the institutional level AWEF is working with fintech institutions to strengthen the supply of digital financial services. It is supporting them in the development of gender-focused strategies, tailored products and marketing or distribution channels that cater to women’s specific needs. Currently AWEF is piloting the very first female agent network in Egypt in partnership with a leading e-payment network in the country.

- At the enabling environment level, based on its work, AWEF is generating and disseminating insights on main challenges, opportunities and innovative models for closing the digital and financial gender gaps in Egypt.

With AWEF’s Financial Inclusion strategy in place we look forward to sharing more on our experience piloting innovative business models to accelerate women’s digital financial inclusion in Egypt and in the MENA region.

Women’s financial and digital financial inclusion has been less studied in the MENA region compared to other regions. The extent to which digital financial services can contribute to women’s agency and empowerment also needs to be better understood. By building a sound learning agenda AWEF aims to bridge these research gaps.

The global gender gap in access to finance terms is not going to close on its own. By identifying systemic issues and successful solutions to women’s financial inclusion in a collaborative and holistic manner we multiply our chances of having an impact on more women, their families and communities.

______________________________________________________________________

Chloé Gueguen is a digital finance specialist and a relentless advocate of leveraging 'Fintech' innovations to create meaningful financial solutions for low-income people, especially poor or disadvantaged women.

AWEF is funded by the U.K. Department for International Development (DFID). It is implemented by three organisations: DAI, MarketShare Associates, and Education for Employment, a network of NGOs that works across education, entrepreneurship, and employment in MENA.

This blog was first published in partnership with the SEEP network

1 comment

Igor Kaparis (the CEO of International Fintech) says, "This initiative welcomes women from all age groups, countries, industry, and disciplines with a great interest in finance. FinTech is playing a key role in shaping the financial sector landscape, but its development will remain unfulfilled unless diversity is prioritized”.

Add your comment

Sign up or log in to comment and contribute.

Sign up